Update:

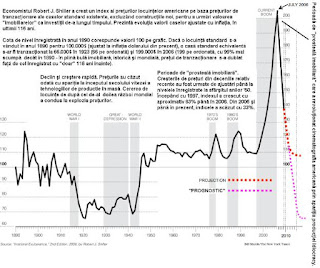

_________________________________________________... if you believe that the economic growth since 1996 was robust enough to justify the doubling of home prices during that time, then perhaps home prices are now at the “correct” levels. But if you believe that most of the economic growth since 1996 was built on bubbles and debt, then it’s hard to find a reason why homes should be twice as expensive. Sursa

“In the Spring and Summer of 1994, Secretary Henry Cisneros met with leaders of major national organizations from the housing industry to solicit their views about establishing a national homeownership partnership.”

- HUD, "Partners in the American Dream", May 1995

“In 1994, at the President’s request, the U.S. Department of Housing and Urban Development (HUD) began work to develop a National Homeownership Strategy with the goal of lifting the overall homeownership rate to 67.5 percent by the end of the year 2000.” - U.S. Department of Housing and Urban Development Office of Policy Development and Research website

"At the request of President Clinton, HUD is working with dozens of national leaders in government and the housing industry to implement the National Homeownership Strategy, an unprecedented public-private partnership to increase homeownership to a record-high level over the next 6 years.” - Urban Policy Brief Number 2, August 1995

The National Homeownership Strategy (NHS) was a massive, complex, coordinated undertaking. The NHS’ integrated effort included alliances with influential public, private and non-profit entities. At the time of publication in 1995 there were 56 “National Partnerships” including the American Bankers Association, Appraisal Institute, Fannie Mae, Federal Home Loan Bank System, Freddie Mac, Mortgage Bankers Association of America, Mortgage Insurance Companies of America, National Association of Home Builders, National Association of Real Estate Brokers, National Foundation of Consumer Credit, National Urban League and HUD.

The public policy initiative consisted of 100 distinct action items detailed within “The National Homeownership Strategy: Partners in the American Dream” released by HUD in May 1995.Loosened lending standards, increased access to credit and a massive reallocation of capital dramatically expanded demand for houses. As would be expected anytime demand grows faster than supply creating relative scarcity, prices started to rise.

While the NHS achieved its objective of record homeownership gains, in doing so it also originated a housing price bubble which distorted economic activity for a decade and ultimately caused the ongoing Affordable Mortgage Depression.

The National Homeownership Strategy cites four fundamental benefits:” Urban Policy Brief Number 2, August 1995

* "Through homeownership, a family...invests in an asset that can grow in value and... generate financial security."

* "Homeownership enables people to have greater control and exercise more responsibility over their living environment."

* "Homeownership helps stabilize neighborhoods and strengthen communities."

* "Homeownership helps generate jobs and stimulate economic growth."

TheAffordableMortgageDepression.com observes that the net effect of The National Homeownership Strategy was to:

* Create overvalued and overleveraged housing assets that are falling in value and undermining financial security* Encourage people to behave irresponsibility and undermine control over living environments

* Destabilize neighborhoods and weaken the communities dependent upon them

* Destroy jobs and disrupt economic growth

Phase Transitions, Symmetry and Post-Bubble Declines

Learn to recognize patterns